capital gains tax changes 2021 uk

Step 3 The result is the maximum chargeable gain. Currently the standard rate for Capital Gains Tax stands at 10 with a higher rate of 20 18 and 28 for residential property whilst the basic income tax rate is 20 rising to 45 for additional rate taxpayers.

The States With The Highest Capital Gains Tax Rates The Motley Fool

These included aligning rates of CGT to income tax levels and cutting the annual gains allowance from 12300 to as little as 2000 per person but with fewer assets attracting the charge.

. Product update Version 202121. The changes in tax rates could be as follows. 10 on assets 18 on property.

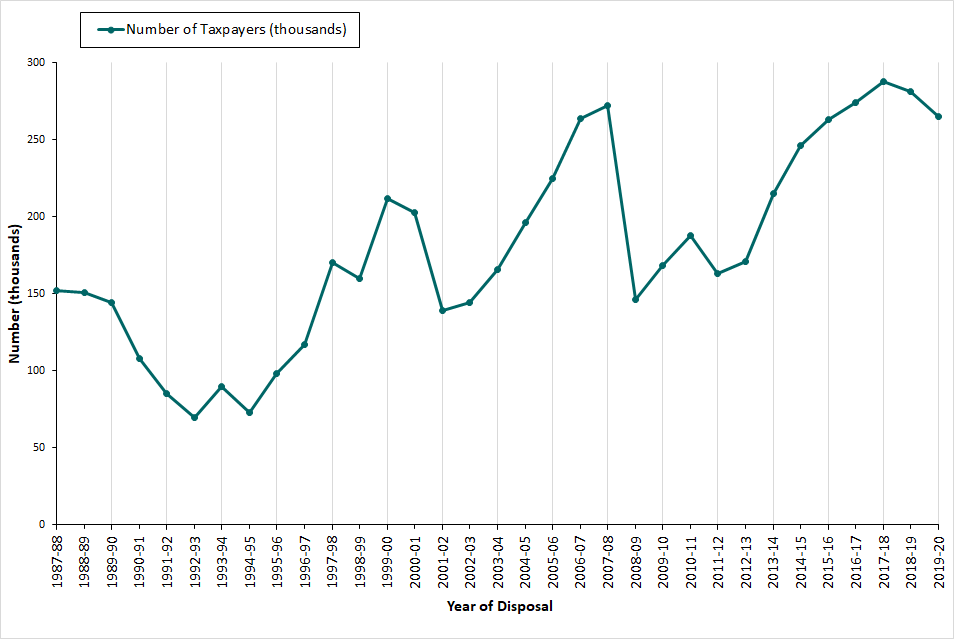

This helpsheet will help you to fill in the Capital Gains Tax summary pages of your 2020 to 2021 tax. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Any gain over that amount is taxed at what appears to be particularly favourable rates with basic rate taxpayers paying tax at 10 or 18 on residential property and high or higher rate taxpayers only incurring.

Step 2 Multiply the figure at step 1 by 53. This was one of the recommendations the OTS had outlined in its report saying the 30-day. Information relating to State pension will now appear on the questionnaire for people born before 6.

Capital tax reform could introduce higher Capital Gains Tax rates over the next few years or alternatively the thresholds. The change will have effect on and after 6 April 2021. 20 on assets and property.

For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. Once again no change to CGT rates was announced which actually came as no surprise.

It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March. Reducing the annual allowance would mean more people. This could result in a significant increase in CGT rates if this recommendation is implemented.

The same change will also apply for non-UK residents disposing of property. 53 weeks was applicable for the 201920 tax year. Capital Gains Tax for non-residents on UK residential property.

Despite record levels of MA activity in the build-up to the Budget with Azets advising on 50 deals in just ten weeks no announcement was made and. Budget 2021 - Overview of Changes Administration and Compliance Changes Capital Gains Tax CGT. Although changes to the corporation tax rate were announced there was no increase in the Capital Gains Tax CGT rate however this.

118 Capital Gains Tax. Extended reporting and payment deadline. The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic.

You can change your cookie settings at any time. The rate for profits under 50000 stays at 19 and there is now also relief for businesses with profits of less than 250000. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners to increase the extent to which these are subject to income tax.

Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four. In the Spring 2021 Budget the Chancellor announced a wide range of tax changes for UK property investors with a strong emphasis on encouraging capital spending as a route to achieving recovery in the economy. 2020 to 2021 2019 to 2020 2018 to 2019.

From 6 April 2020 if you. This rate change will impact UK resident companies and also. The necessary legislation will be introduced in Finance Bill 202122 and will also clarify that for UK residents where the gain relates to mixed-use property only the residential property portion of the gains has to be returned and paid.

Non-resident Capital Gains Tax on the. The OTS review of CGT published in September suggested four key changes as part of an overhaul. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it.

Step 1 Work out the amount by which the disposal exceeds 6000. The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. Update for the system to calculate Class 2 NIC at 52 weeks in the year.

Proposed changes to Capital Gains Tax. Relief for gifts of business assets. In the Spring Budget the then-Chancellor also announced that from April 2023 the rate of corporation tax would increase to 25 on profits over 250000.

In the 2021 Autumn Budget Chancellor Rishi Sunak announced that the deadline for people to report and pay the CGT owing from the sale of a property was being immediately increased to 60 days up from 30 days.

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax Commentary Gov Uk

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

2022 Capital Gains Tax Rates In Europe Tax Foundation

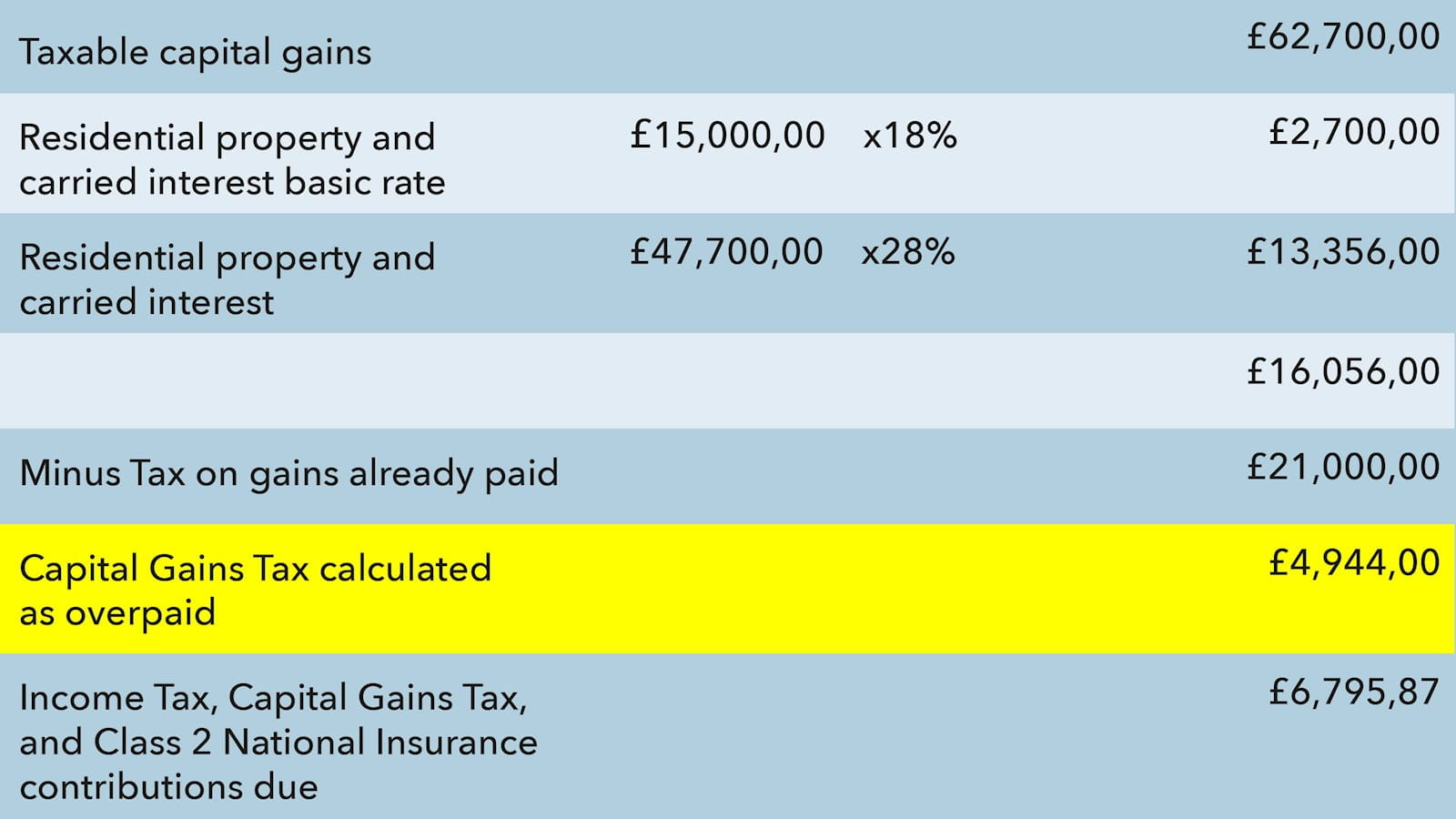

Offsetting Overpaid Cgt Against Income Tax Icaew

What Are Capital Gains Tax Rates In Uk Taxscouts

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax System In Nepal An Overview Corporate Lawyer Nepal

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

How To Tax Capital Without Hurting Investment The Economist

Difference Between Income Tax And Capital Gains Tax Difference Between

Taxation Rules On Stocks And Shares Sharesexplained Com

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Capital Gains Tax Examples Low Incomes Tax Reform Group